Top Professional ZATCA Integration Services in Saudi Arabia by MHK Services

What Are ZATCA Integration Services and Why They Matter

ZATCA (Zakat, Tax and Customs Authority) integration is the direct process of connecting ERP and accounting systems with Saudi Arabia’s e‑invoice and tax compliance platforms. Expert ZATCA Compliance Integration Services in Saudi Arabia ensure businesses remain regulator‑aligned, transparent, and audit‑ready while avoiding penalties and compliance risks.

MHK Services provides best ZATCA Integration Services in KSA, delivering regulator‑aligned implementation, structured advisory, and compliance monitoring. Our licensed consultants directly manage ZATCA Compliance Integration to strengthen governance, reduce risks, and ensure compliance with Saudi tax laws and e‑invoice mandates.

What Types of Expert ZATCA Integration Services Do Businesses Need in KSA

To maintain robust governance and compliance, MHK Services provides professional ZATCA Integration Services in KSA, including:

E‑Invoice Integration

Expert deployment of regulator‑aligned e‑invoice systems in Saudi Arabia.

ERP & Accounting System Connectivity

Professional advisory for linking ERP platforms with ZATCA in KSA.

API Configuration & Testing

Best advisory for regulator‑aligned API setups in Saudi Arabia.

Compliance Monitoring

Expert validation of e‑invoice submissions in KSA.

Training & Support

Top onboarding for regulator‑aligned ZATCA compliance in Saudi Arabia.

What Are the Benefits of Professional ZATCA Compliance Integration Services in Saudi Arabia

Engaging MHK Services for expert ZATCA Integration in Saudi Arabia ensures measurable advantages:

Regulatory Compliance

Professional frameworks aligned with Saudi tax laws and regulator requirements.

Reduced Risk of Penalties

Best documentation practices prevent fines and regulator queries in KSA.

Operational Efficiency

Expert integrations reduce duplication, save costs, and improve accuracy in Saudi Arabia.

Investor Confidence

Transparent, regulator‑ready compliance builds credibility with stakeholders in KSA.

Future‑Ready Systems

Top advisory ensures scalable ERP integrations aligned with Saudi mandates.

Compliance Timelines for ZATCA Integration Services in KSA

Timely integration is crucial for regulator confidence. MHK Services helps businesses in KSA meet deadlines while maintaining accurate governance records:

Initial Assessment

Completed within 2–3 weeks, ensuring regulator‑aligned documentation.

ERP & API Integration

Finalized within 4–6 weeks, aligned with KSA compliance requirements.

Testing & Advisory

Conducted within 6–8 weeks, ensuring audit‑ready workflows.

Monitoring & Compliance Validation

Completed within 2–3 weeks, ensuring regulator‑aligned operations.

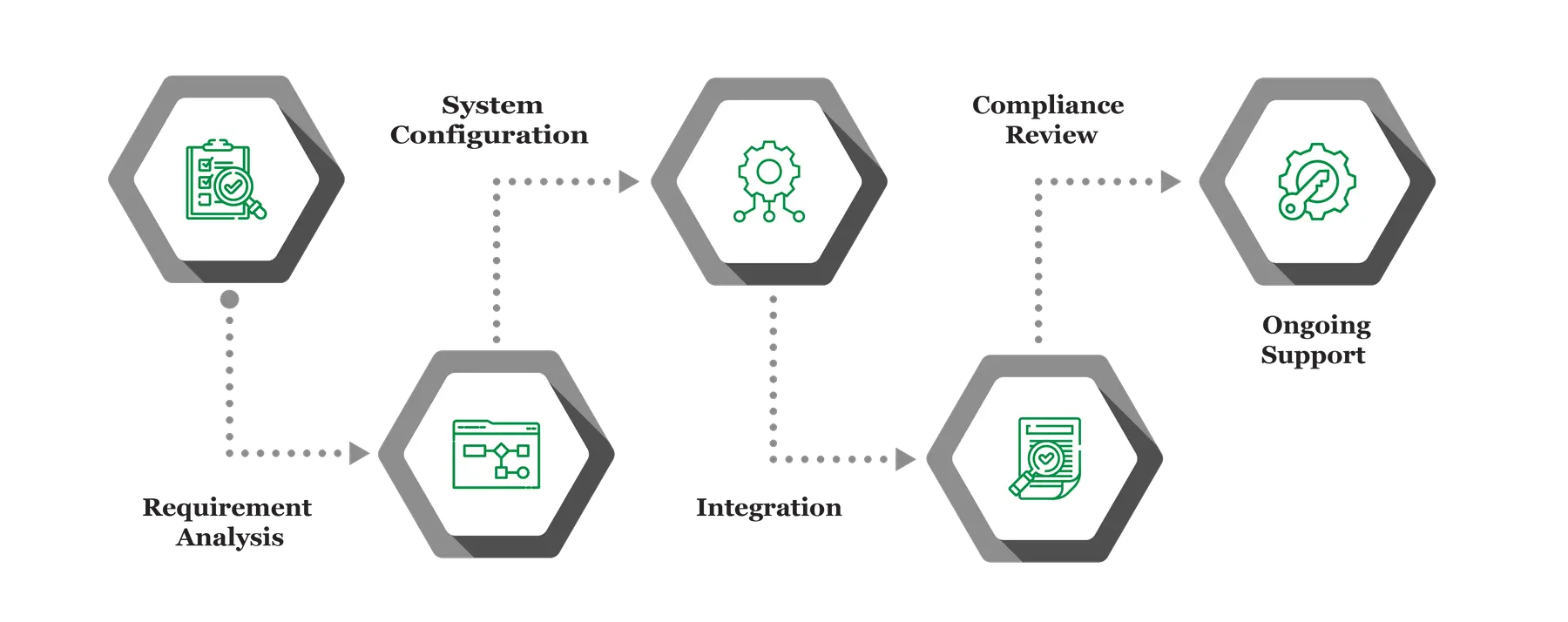

Our Process for Facilitating Expert ZATCA Integration Services in Saudi Arabia

MHK Services follows a structured approach to deliver professional ZATCA integration in Saudi Arabia, ensuring accuracy and regulatory compliance:

Requirement Analysis

We review ERP and compliance needs, identify gaps, and design frameworks aligned with Saudi regulations.

System Configuration

We configure ERP and accounting systems, embed compliance validations, and align workflows with ZATCA standards.

Integration

We deploy APIs, restructure processes, and automate reporting.

Compliance Review

We verify operations against Saudi laws, ensuring regulator‑aligned documentation.

Ongoing Support

Continuous advisory is provided to keep companies aligned with evolving ZATCA regulations.

What Challenges Do Companies Face in ZATCA Integration Services in Saudi Arabia

Businesses across Saudi Arabia often face challenges such as incomplete records, compliance gaps, frequent regulator queries, and limited ERP awareness. MHK Services addresses these issues through expert advisory and audit‑ready documentation.

Incomplete Records

Missing documentation delays integration. MHK Services prepares complete, organized ERP records for Saudi regulators.

Compliance Gaps

Inconsistent frameworks cause risks. MHK Services ensures secure, accurate advisory aligned with regulator standards.

Regulator Queries

Authorities demand clarifications. MHK Services prepares structured responses, minimizing follow‑ups.

Limited Awareness of ERP Standards

SMEs often lack expertise. MHK Services provides training and advisory for Saudi compliance.

Book an Appointment with Us

Schedule a consultation with MHK Services today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

Related Posts

Documents Required for ZATCA Integration Services in KSA

Accurate documentation is essential for compliance and regulator confidence. MHK Services ensures businesses in KSA prepare and maintain all required records to support transparency.

- Corporate registration documents

- ERP system records

- Tax compliance certificates

- Audit trails

- API configuration reports

Contact Us

Which Laws and Authorities Govern ZATCA Integration in Saudi Arabia

ZATCA Compliance Integration in Saudi Arabia is governed by strict frameworks. MHK Services ensures businesses in Saudi Arabia meet all requirements by aligning systems with national authorities.

ZATCA Saudi Arabia – Oversees e‑invoice and tax compliance.

Ministry of Commerce Saudi Arabia – Governs corporate documentation.

MISA Saudi Arabia – Oversees investment and compliance approvals.

SOCPA Saudi Arabia – Sets accounting and audit documentation standards.

Saudi Central Bank (SAMA) – Oversees ERP compliance for financial institutions.

Cost & Pricing Overview for ZATCA Integration Services in KSA

Pricing depends on complexity and company needs. MHK Services provides expert ZATCA guidance in KSA on cost considerations:

- Company Size – Larger firms require extensive ERP integrations.

- Customization Depth – Tailored advisory adds moderate costs.

- Integration Effort – Multi‑entity setups increase preparation requirements.

Technology & Tools Used in ZATCA Integration Services in Saudi Arabia

MHK Services uses trusted platforms in Saudi Arabia to deliver secure, compliant ERP solutions.

Industries We Serve with ZATCA Integration Services in KSA

MHK Services provides customized ZATCA Compliance Integration in KSA across diverse industries:

- Banking & Finance KSA

- Healthcare & Pharmaceuticals Saudi Arabia

- Real Estate & Construction KSA

- Retail & E‑Commerce Saudi Arabia

- SMEs & Family Businesses KSA

Why Choose MHK Services for Expert ZATCA Integration Services in Saudi Arabia

Partnering with MHK Services ensures top ZATCA Integration in Saudi Arabia that combines regulatory knowledge, licensed professionals, and modern tools to deliver accurate, audit‑ready documentation.

- Compliance with Saudi ZATCA regulatory requirements

- Regulator‑ready, transparent documentation

- Integrated ERP and ZATCA solutions

- Customized services for industries

- Continuous advisory and support

Contact MHK Services for Professional ZATCA Integration Services in Saudi Arabia

Expert ZATCA Integration Services in Saudi Arabia ensure compliance, transparency, and operational efficiency. MHK Services delivers licensed ERP expertise, prepares regulator‑ready documentation, and supports accurate governance. Schedule your consultation today for a customized integration roadmap tailored to your business needs.

FAQ's

Typically 4–6 weeks depending on company size and documentation quality.

Delays may cause penalties, regulator queries, or operational disruptions.

Yes, scalable and customized solutions are available for small and medium businesses.

Yes, structured records minimize audit clarifications and regulator follow‑ups.