Top Financial Advisory Services in Saudi Arabia by MHK Services

What Is Financial Advisory and Why It Matters

Businesses in Saudi Arabia require structured financial guidance to sustain growth, manage compliance, and attract investors. Professional Financial Advisory Services in KSA coordinated through MHK Services provide regulator‑ready strategies, transparent reporting, and informed decision‑making support.

These solutions are facilitated through licensed experts and advisory professionals. The indirect approach guarantees structured planning, compliance oversight, and accurate documentation, enabling businesses to operate efficiently while meeting ZATCA, SOCPA, and IFRS requirements.

What Types of Financial Advisory Services Do Businesses Need in Saudi Arabia

Companies face diverse financial challenges that demand coordinated solutions. Expert Financial Advisory Services in Saudi Arabia address both strategic and operational requirements.

Corporate Finance Advisory – Guidance on capital structuring, mergers, acquisitions, and investment decisions.

Risk Management Advisory – Identifying, assessing, and mitigating financial risks to sustain stability.

Regulatory Advisory – Ensuring compliance with ZATCA, SOCPA, and IFRS standards.

Investment Advisory – Supporting portfolio management, valuation, and investor relations.

ERP & Financial Systems Advisory – Implementing SAP, Oracle NetSuite, and Odoo ERP for efficient financial workflows.

What Are the Benefits of Best Financial Advisory Services

Engaging Top Financial Advisory Services in Saudi Arabia ensures businesses gain measurable advantages from structured advisory solutions.

- Compliance – Adherence to ZATCA, SOCPA, and IFRS standards.

- Transparency – Clear reporting builds investor and stakeholder trust.

- Accuracy – Reliable insights strengthen compliance and decision‑making.

- Efficiency – Streamlined processes reduce operational waste.

Compliance Timelines for Financial Advisory in Saudi Arabia

Timely execution of advisory responsibilities is critical for compliance and governance. Structured timelines coordinated through MHK Services ensure regulator‑ready outcomes.

- Monthly Oversight – Advisory reports and variance analysis delivered within 10 business days.

- Quarterly Reporting – Strategic and operational reports prepared for compliance and investor communication.

- Annual Forecasting – Budgets and forecasts aligned with fiscal year‑end requirements.

- Regulatory Filings – VAT and compliance submissions scheduled to meet ZATCA deadlines.

Professional financial advisory services provide clear milestones, ensuring businesses remain compliant, efficient, and investor‑ready.

Our Process for Facilitating Financial Advisory in Saudi Arabia

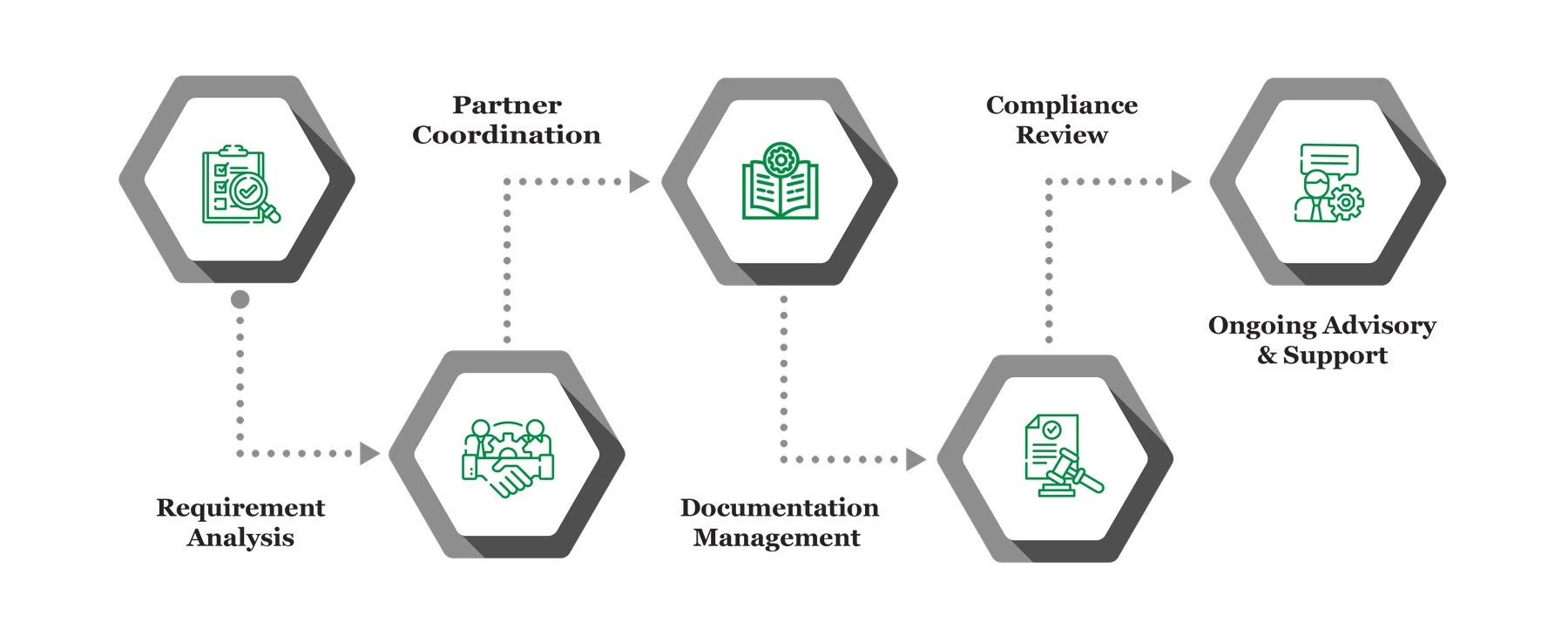

A structured process ensures consistent, regulator‑ready outcomes.

Requirement Analysis – Financial processes, reporting gaps, and objectives are reviewed to define scope. Coordination ensures alignment with KSA regulations, enabling businesses to indirectly achieve compliance, efficiency, and investor‑ready documentation without disruption.

Partner Coordination – Licensed finance experts are engaged to execute planning, reporting, and compliance tasks. MHK Services indirectly facilitates regulator‑ready outputs, ensuring businesses receive structured, accurate, and compliant financial leadership aligned with Saudi Arabia’s governance standards.

Documentation Management – Advisory reports, forecasts, and reconciliations are organized for clarity and traceability.

Compliance Review – Reports and strategies are validated against ZATCA, SOCPA, and IFRS requirements to avoid penalties and sustain governance.

Ongoing Advisory & Support – Continuous monitoring, updates, and strategic guidance are coordinated through licensed experts, ensuring sustained compliance and investor‑ready outcomes.

Book an Appointment with Us

Schedule a consultation with MHK Services today and discover how our expert Actuarial Valuation and financial consulting services can enhance the accuracy and reliability of your financial records.

What Challenges Do Companies Face in Financial Advisory

Companies often lack in‑house expertise to manage strategic finance and compliance. Without Professional Financial Advisory Services in KSA, businesses risk inefficiency, penalties, and weak investor communication.

Limited Strategic Insight – Businesses struggle to align financial goals with corporate objectives, requiring structured analysis and regulator‑ready documentation.

Cash Flow Inefficiency – Poor liquidity management increases operational risk and weakens growth, demanding structured oversight.

Regulatory Compliance Risks – Incomplete or inaccurate reporting may trigger penalties and governance issues.

Stakeholder Communication Gaps – Unclear reporting reduces investor trust and credibility, weakening governance.

Contact Us

Documents Required for Financial Advisory in Saudi Arabia

Effective advisory requires organized documentation. MHK Services helps businesses across KSA maintain regulator‑ready records.

- Historical financial statements and ledgers

- Budgets, forecasts, and strategic plans

- Cash flow and working capital reports

- Compliance filings and audit trails

- Contracts, leases, and investment agreements

Which Laws and Authorities Govern Financial Advisory in Saudi Arabia

Financial advisory operates under strict regulatory oversight. MHK Services ensures compliance with:

- ZATCA – VAT compliance and reporting

- SOCPA – Accounting standards and advisory regulations

- CMA – Investor reporting and disclosures

- Ministry of Commerce – Corporate governance and filings

Cost & Pricing Overview for Financial Advisory

Costs vary depending on company size, operational complexity, and integration needs. MHK Services guides businesses in Saudi Arabia to plan budgets efficiently.

- Company Size – Larger corporations require comprehensive services; SMEs have simpler scopes.

- Operational Complexity – Multiple divisions increase planning effort.

- Integration Needs – ERP and reporting systems affect cost and timelines.

Technology & Tools Used in Financial Advisory

Trusted technology ensures accurate, efficient, and regulator‑ready advisory. These tools streamline compliance, reporting, and financial oversight.

Industries We Serve with Financial Advisory in Saudi Arabia

Solutions coordinated through MHK Services benefit companies across diverse sectors. These offerings are scalable and aligned with industry‑specific compliance and reporting needs.

- Retail & E‑Commerce – Pricing and reporting optimization.

- Healthcare & Pharmaceuticals – Financial planning and compliance oversight.

- Real Estate & Construction – Project budgeting and cash flow management.

- Finance & Banking – Investor transparency and compliance reporting.

- SMEs & Family‑Owned Businesses – Structured advisory solutions aligned with growth needs.

Why Choose MHK Services for Financial Advisory

Expert Financial Advisory Services in Saudi Arabia deliver regulator‑ready strategies, industry‑specific solutions, and continuous advisory support. Businesses benefit from licensed expertise, modern tools, and compliance knowledge.

- Alignment with KSA regulations and governance standards

- Regulator‑ready reporting and strategies

- Integrated ERP and analytics tools

- Customised solutions for company size and industry

- Continuous advisory and monitoring

Contact MHK Services for Financial Advisory in Saudi Arabia

Top Financial Advisory Services in Saudi Arabia ensure strategic, regulator‑aligned financial leadership. Licensed experts coordinate accurate reporting and support informed decision‑making, with consultation available for customized advisory roadmaps and compliance checklists.

FAQ's

How long does financial advisory setup take?

Professional Financial Advisory Services in KSA are typically set up within six to ten weeks, depending on company size and reporting complexity.

Can SMEs access advisory solutions?

Yes, scalable and affordable solutions are available for SMEs, aligned with their operational and compliance needs.

Are these services compliant with Saudi regulations?

Absolutely, all strategies follow ZATCA, SOCPA, and MoC requirements to ensure regulator‑ready outcomes.

Does financial advisory improve investor confidence?

Yes, transparent reporting and structured dashboards strengthen stakeholder trust and credibility.

Is technology integrated into financial advisory services?

Yes, ERP and analytics tools streamline compliance, reporting, and financial oversight.