Zakat Filing Services in Saudi Arabia by MHK Services

What Are Zakat Filing Services and Why They Matter

Zakat is a mandatory religious and financial obligation in Saudi Arabia, regulated by the Zakat, Tax and Customs Authority (ZATCA). It applies to Saudi‑owned businesses and certain entities operating in the Kingdom. Professional Zakat Filing Services in KSA are coordinated through MHK Services with licensed tax advisors and compliance specialists. These services ensure regulator‑ready documentation, accurate calculations, and transparent reporting aligned with ZATCA requirements.

Zakat filing matters because it is both a religious duty and a regulatory requirement. Non‑compliance can lead to penalties, reputational damage, and investor concerns. Properly coordinated filing strengthens governance, supports social responsibility, and ensures compliance with Saudi Arabia’s evolving tax framework.

What Types of Zakat Filing Services Do Businesses Need

Annual Zakat Calculation

Structured computation of zakat obligations based on financial statements and ownership structures.

Zakat Return Preparation

Preparation and submission of annual zakat returns to ZATCA.

Compliance Advisory

Guidance on aligning zakat filings with ZATCA regulations and SOCPA standards.

ERP & Systems Integration

SAP, Oracle NetSuite, and Odoo ERP systems aligned to track zakat obligations.

Penalty Reconsiderations

Structured appeals coordinated to challenge ZATCA penalties or assessments related to zakat filings.

What Are the Benefits of Coordinated Zakat Filing

Engaging MHK Services ensures businesses in Saudi Arabia gain measurable advantages from structured zakat filing.

- Ensures compliance with ZATCA regulations and deadlines.

- Reduces risks of penalties and regulator queries.

- Strengthens investor confidence with transparent reporting.

- Improves efficiency through structured zakat planning.

- Supports long‑term growth with regulator‑ready documentation.

Compliance Timelines for Zakat Filing in Saudi Arabia

Timely compliance is critical for governance and operations. MHK Services coordinates structured timelines to ensure regulator‑ready outcomes.

- Annual Zakat Calculation – Conducted within 4–6 weeks after year‑end.

- Zakat Return Preparation – Submitted within statutory deadlines defined by ZATCA.

- Penalty Reconsiderations – Filed within 30 days of assessment.

- Ongoing Advisory – Continuous support provided throughout the year.

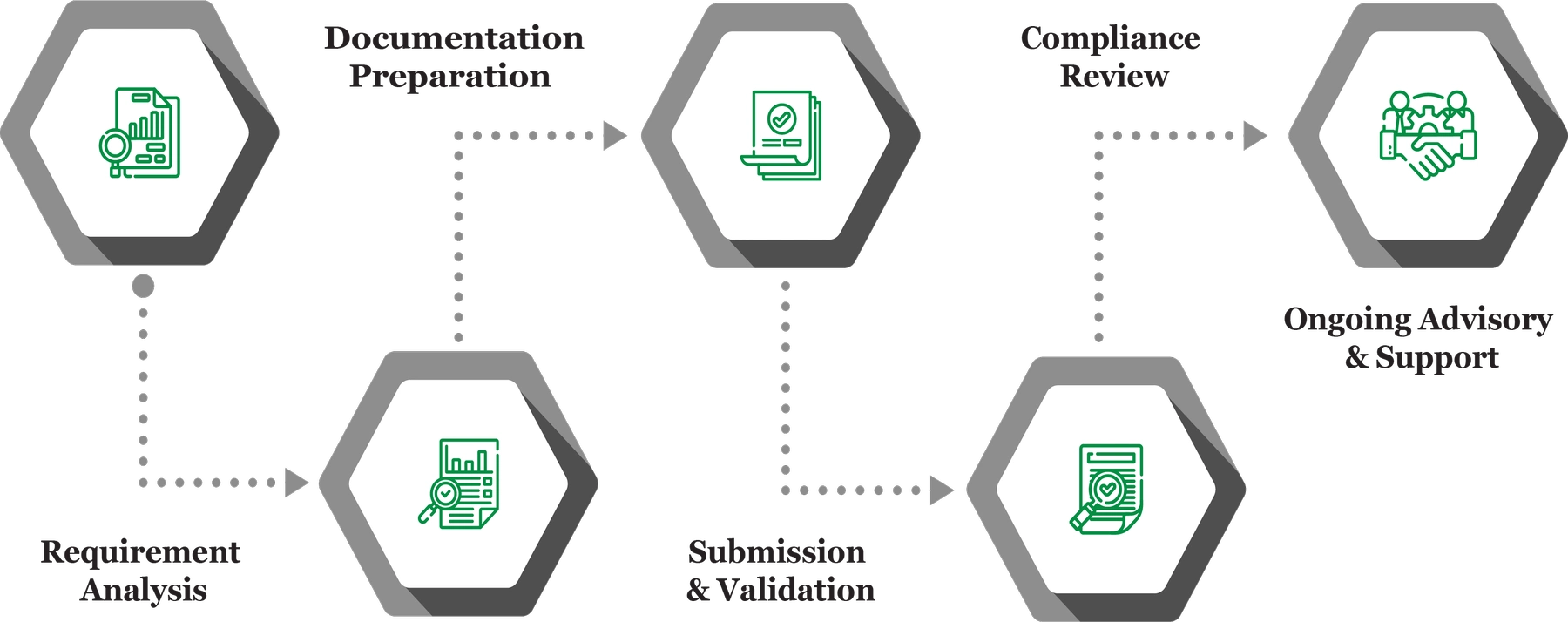

Our Process for Facilitating Zakat Filing

Requirement Analysis

Business operations, ownership structures, and compliance needs are reviewed to define scope. Coordination ensures alignment with ZATCA regulations.

Documentation Preparation

Licensed tax advisors prepare zakat filings with regulator‑ready accuracy.

Submission & Validation

Returns coordinated through ZATCA, ensuring compliance with statutory requirements.

Compliance Review

Reports validated against ZATCA, SOCPA, and IFRS standards to ensure regulator‑ready documentation.

Ongoing Advisory & Support

Continuous monitoring and updates coordinated to sustain compliance with evolving regulations.

What Challenges Do Companies Face in Zakat Filing

Incomplete Documentation

Missing invoices or reconciliations reduce accuracy and credibility.

Frequent Regulatory Changes

Evolving ZATCA requirements create compliance risks for businesses.

Penalty Risks

Late filings or inaccurate submissions may trigger fines.

Investor Confidence Issues

Unclear reporting reduces trust and credibility.

Operational Inefficiencies

Weak processes or outdated systems increase compliance risks.

Documents Required for Zakat Filing in Saudi Arabia

Businesses should maintain organized documentation to ensure compliance. MHK Services coordinates preparation of:

- Financial statements and ledgers

- Ownership records and shareholder details

- Contracts and governance documents

- Payroll and HR records

- Compliance filings and audit trails

Contact Us

Which Laws and Authorities Govern Zakat Filing in Saudi Arabia

Zakat filing operates under strict regulatory oversight. MHK Services ensures compliance with:

- ZATCA – Zakat regulations and reporting requirements

- SOCPA – Accounting standards and audit regulations

- IFRS – International reporting standards

- Ministry of Commerce – Licensing and governance filings

- Shariah Principles – Religious framework guiding zakat obligations

Cost & Pricing Overview for Zakat Filing Services

Costs vary by company size, ownership structure, and integration needs. MHK Services coordinates pricing considerations:

- Larger corporations require comprehensive zakat management.

- SMEs benefit from scalable, cost‑efficient advisory.

- Complex ownership structures increase advisory effort.

- ERP and reporting systems affect cost and timelines.

Technology & Tools Used in Zakat Filing

Global ERP and analytics tools coordinated through MHK Services ensure accuracy and compliance.

Industries We Serve with Zakat Filing in Saudi Arabia

Solutions coordinated through MHK Services benefit companies across diverse sectors. These offerings are structured to meet industry‑specific compliance and reporting needs.

- Retail & E‑Commerce – Zakat compliance for sales and ownership structures.

- Healthcare & Pharmaceuticals – Advisory for procurement and distribution.

- Real Estate & Construction – Zakat filing for project ownership and capital reporting.

- Finance & Banking – Investor reporting and transparent disclosures.

- SMEs & Family‑Owned Businesses – Scalable zakat solutions aligned with growth needs.

Why Choose MHK Services for Zakat Filing

Zakat filing coordinated through MHK Services delivers regulator‑ready strategies, industry‑specific solutions, and continuous support.

- Alignment with ZATCA regulations and governance standards

- Transparent reporting and documentation

- Integrated ERP and analytics tools

- Industry‑specific coordination

- Continuous advisory and monitoring

Contact MHK Services for Zakat Filing in Saudi Arabia

Zakat filing in Saudi Arabia is coordinated through MHK Services with licensed experts. Regulator‑ready documentation and accurate reporting are facilitated for compliance and transparency. Consultation is available for customized zakat filing checklists.

FAQs: Zakat Filing in Saudi Arabia

Zakat filings are annual, submitted within statutory deadlines defined by ZATCA.

Yes, scalable solutions are available for SMEs, aligned with compliance needs.

All strategies follow ZATCA, SOCPA, IFRS, and MoC requirements.

Transparent reporting and structured disclosures strengthen trust and credibility.

ERP and analytics tools streamline compliance, reporting, and zakat oversight.